This article is part of the first section of an August 2025 update on the Chinese webshop Temu (Temu Watch #9), published by ChinaTalk’s Ed Sander on Tech Buzz China.

Changes in US tax policies and de minimis policies have had a significant impact on the performance of major cross-border e-commerce platforms in the first half of 2025. In the first quarter of 2025, Temu’s total merchandise volume increased by 15% to 20% compared with the same period last year. However, due to the adjustment of the de minimis policy in April, sellers became hesitant in managing inventory. As we discussed in Temu Watch #8, Temu suspended marketing investment in the US on May 1 when the US eliminated duty-free shipping for small packages under $800. This led to a halving of Temu’s fully managed supply in the second quarter, with 30% of it turning to semi-managed, which in turn caused its total merchandise volume to fall by 20% to 30%.

These changes have had a significant impact on Temu’s market share and revenue. After the business was interrupted in early May, about a third of merchants abandoned the US market and turned to Europe or other regions. Some merchants chose to sell on other platforms, such as Amazon, after a decline in sales due to price increases.

After May 12, with the adjustment of tariff policies, marketing activities resumed. Temu restarted its cross-border parcel service (fully managed model) to the United States in late May, but many products were not put back on the shelves until July. As a result, from May to June, the order volume in the United States was not ideal and did not gradually recover until late July.

Tech Buzz China’s Ed Sander explained at the K5 Conference in Berlin in June why the cancellation of de minimis will not ‘kill’ Temu.

Some products with high historical sales and strong compliance were put back on the shelves at the end of June. By July, sales had returned to April levels, and a large-scale promotion is expected in early August. Regarding the number of SKUs, the number of fully managed SKUs in the United States was about 4 million at the beginning of the year. By early July, this number was about 3.3 million. It is expected that the number of SKUs will have recovered to more than 3.5 million by the end of July. However, the number of fully managed SKUs may not return to 4 million until August.

After the fully managed model was restored, major merchants switched their core products from the semi-managed Y1 model (see below) to the fully managed model. Some merchants who shifted their focus to Europe began to reintroduce European inventory to the US market as the US strategy resumed.

Temu’s operations are expected to rebound in the US. Specifically, it reached 60% to 70% of past levels during Prime Day (July 8-11), and is expected to recover to 80% to 90% by August and September. By early September, 60% of the business volume previously lost in the fully managed model is expected to have recovered.

Sino-US trade relations are expected to enter a new phase on September 1, and tariff policies may be further eased. Before the Geneva meeting on May 12, issues related to fentanyl and trade tariff disputes frequently appeared, being mentioned once every 1-2 weeks, explicitly targeting China. However, since the Geneva meeting, US President Trump has no longer mentioned fentanyl and trade tariff differences.

Although negotiations between China and the United States on issues such as rare earths have not yielded concrete results, the overall atmosphere remains positive. At present, the current tariff level may have reached a peak of 30% (excluding small packages, which are currently exposed to 54%), while tariffs on commodities are expected to drop to 20%. However, given the limited bargaining chips that China can offer, it is almost impossible to return to the original tariff level.

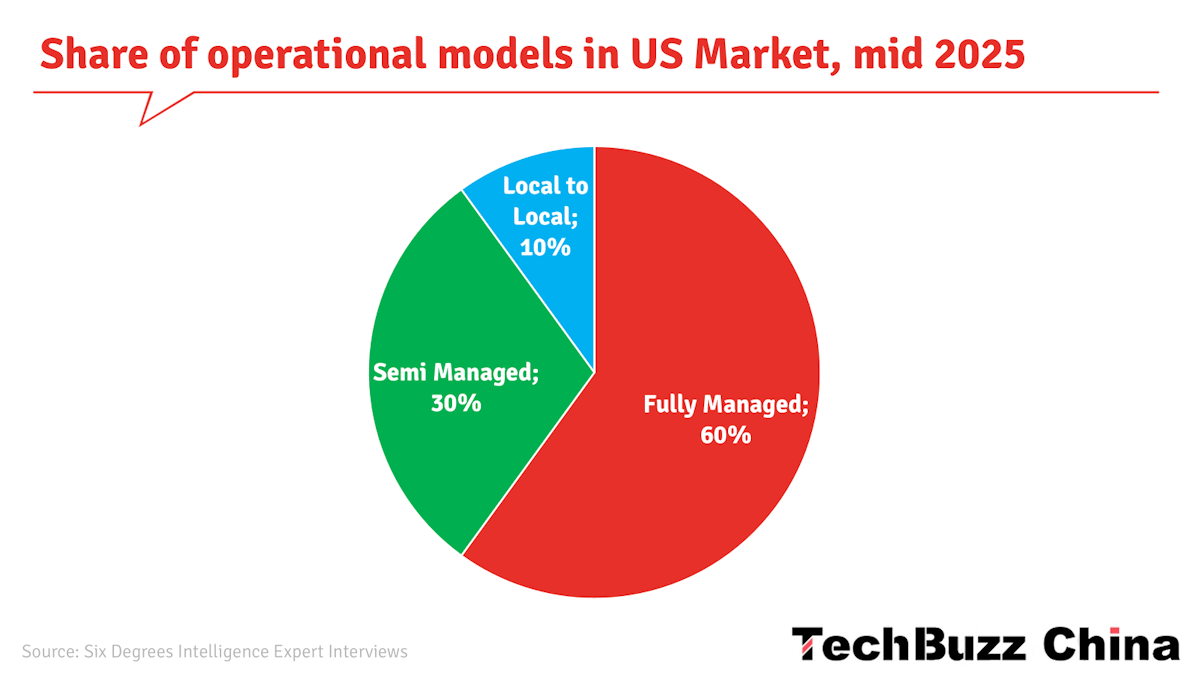

In the US market, the composition ratio of GMV is 60% for fully managed, 30% for semi-managed, and 10% for local-to-local. The tariff on fully managed deliveries has been significantly reduced from the original maximum of 120% to about 54%, which has almost restored the cost of direct shipment to the level before the policy adjustment. By adopting the T01 customs clearance (bulk import of goods over $2500) and a B2B2C model, Temu has successfully kept the prices of most goods unchanged, with only a few highly competitive categories having a slight price increase.

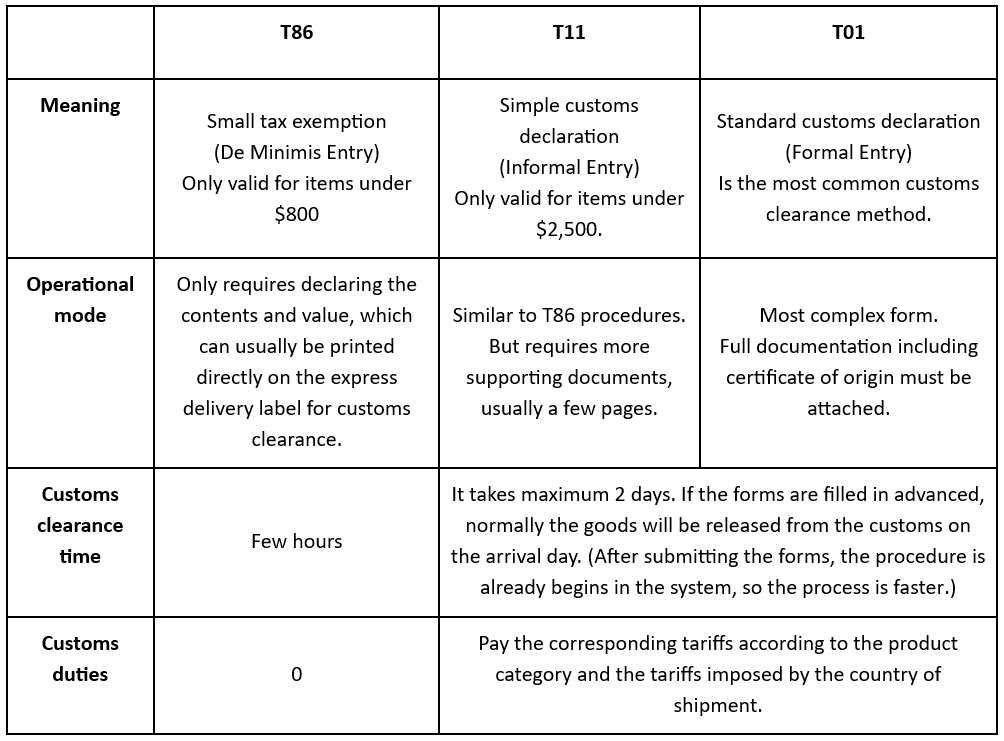

A short explainer about custom policies, courtesy of Latepost.

There are three common customs clearance methods for cross-border e-commerce in the United States. Source: LatePost. [1]

After the cancellation of the T86 (de minimis) policy, cross-border e-commerce goods entering the US have only two options:

- Simplified customs declaration (T11) for goods valued under $2,500

- Standard customs declaration (T01)

Both procedures involve automated inspections, so the real slowdown isn’t the customs formalities, but the queues. If forms are filled out in advance (essentially queuing in advance), goods can generally be released the same day. Even if forms are filled out upon arrival, customs clearance is still possible within two days. Therefore, the customs clearance process doesn’t significantly impact the fulfilment timeframe for Chinese goods. [1]

T01 is the most stringent customs clearance method, requiring the value of goods to be estimated strictly based on the original invoice and country of origin. When the total value of a shipment is high enough, the T01 customs clearance cost per item can be very low. Direct mail parcels are taxed based on the retail price. At the same time, when merchants stock up domestically and move goods to overseas warehouses (as in Temu’s semi-managed model), the value of the goods is declared based on the “purchase cost price” commonly used in corporate trade, and the tax bases of the two are different. [1]

The United States is also stepping up its efforts to prevent countries close to China from engaging in transhipment. In early July, the United States’ new tariffs on Vietnam specifically included a tax requirement for goods transiting through a third country. On July 30th, Trump signed a new executive order suspending the duty-free policy for small packages from all countries starting August 29th, completely severing the tax-free access provided by transhipment. [1]

Offloading to Canada

As traffic in the US app and website has not yet fully recovered, some goods are shipped to Canada first. In the past, goods were shipped from Canada to the United States to circumvent the high inspection rate and certification issues in the United States, but now they are mainly shipped from the United States to Canada. From a logistics perspective, goods shipped from the United States to Canada are usually delivered within 3 to 4 days.

This model of direct shipment from the United States to Canada can not only digest inventory but also improve distribution efficiency in Canada. However, after the fully managed business in the United States is restarted, the transhipment from the United States to Canada will be terminated to avoid additional tariffs. In July, the daily order volume in the Canadian market was about 100,000. With the expansion of the US business in the future, Canada will operate independently.

Want to learn more?

The text above contains part of the first section of the full report. The full 10K word version of this report includes:

▶️ How Temu changed the fully managed model to restart business in the US.

▶️ How it is shifting to new strategies for logistics.

▶️ How it has added new revenue streams.

▶️ How Temu is changing its advertising strategies and why it decreased its advertising budget in the US (guess what, it’s not just because of the tariffs).

▶️ What the expectations for GMV and profitability are in 2025 and 2026.

▶️ What Temu’s expected market share in the US and Europe will be by 2026.

The full text, available to paid Tech Buzz China subscribers, can be found here. If you are not a paid subscriber yet, you can subscribe on the report page.